Know-Your-Customer (KYC) Consulting

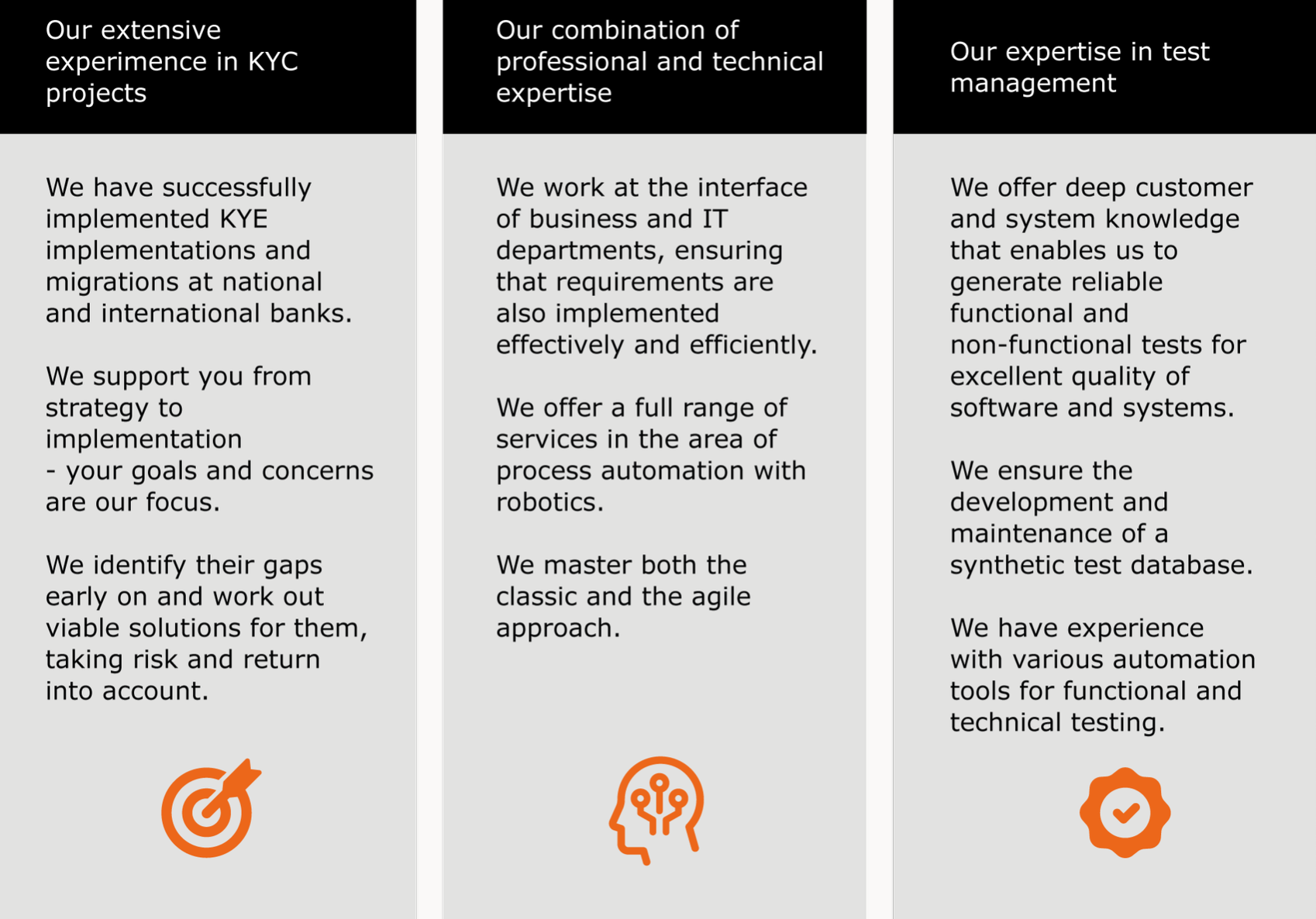

UMS combines technical and IT expertise with KYC-specific know-how to add value to your identification, verification and documentation process.

We are your partner from strategy to implementation

The Know-Your-Customer (KYC) principle refers to the due diligence obligation for obligated parties (see Section 2 (1) Sentence 1 no.1 to 16 of the Money Laundering Act) in the identity verification of their customers and business partners to prevent money laundering and terrorist financing - especially for companies in the financial sector.

By law, a KYC analysis must take place both for new customers during onboarding and for existing customers on a regular or event-triggered basis. The effort required depends on the respective risk classification.

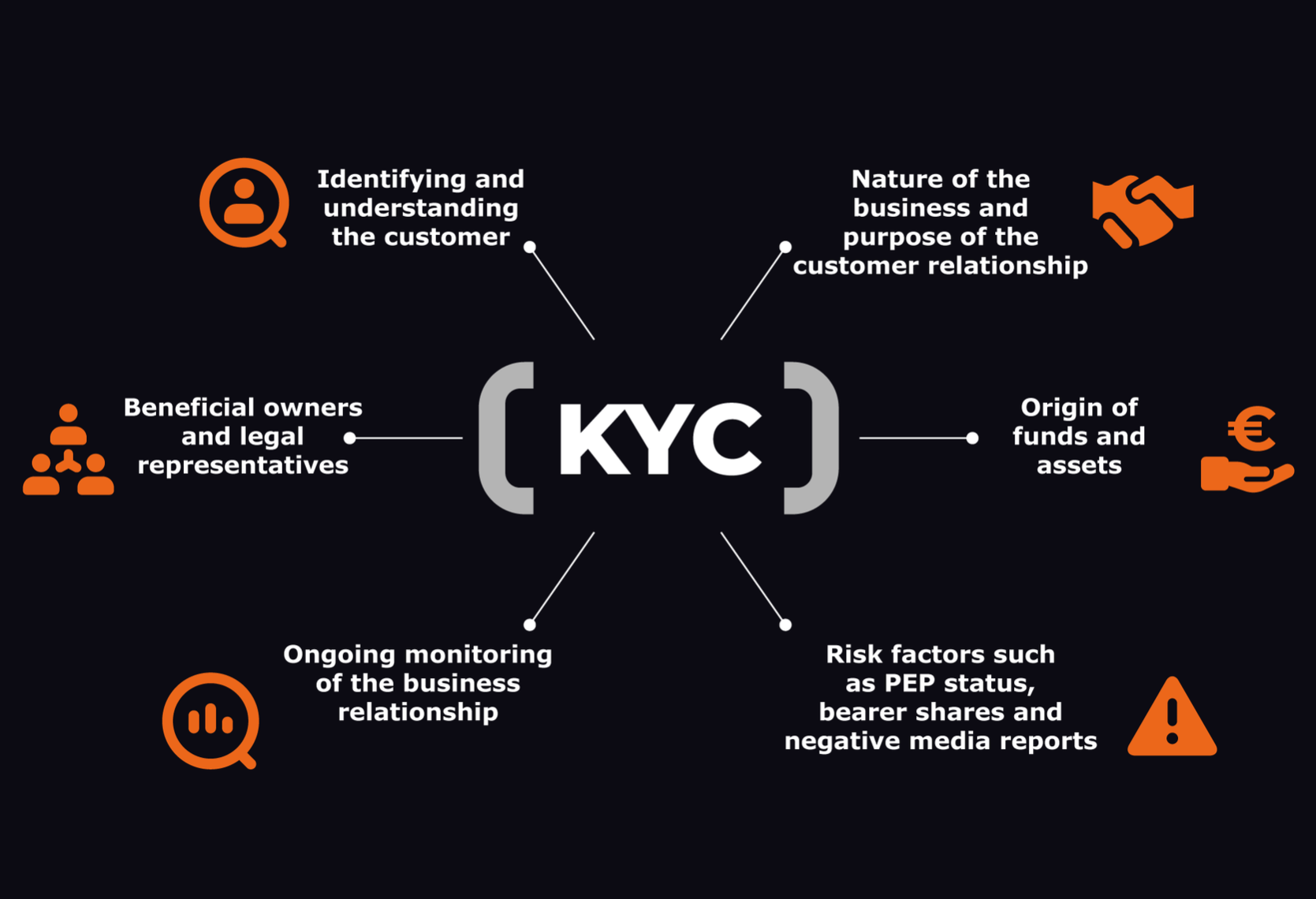

With this audit, certain data is collected based on regulatory requirements and the potential risk is evaluated as part of the due diligence process. These include:

KYC as an Effective Measure for Money Laundering and Fraud Prevention

New regulatory requirements as well as the current system landscape present credit institutions and financial institutions with new stress tests every day in order to introduce a targeted and effective measure for money laundering and fraud prevention in their business policy.

UMS combines technical and IT expertise with KYC-specific know-how to add value to your identification, verification and documentation process.

Would you like to learn how UMS can support you in your KYC measures?

Feel free to contact us or send us an email to finance@ums-gmbh.com.

We are looking forward to it!