FinTech Start-Ups - Hype or serious threat?

VUCA is transforming industries globally and is not stopping at the financial industry. The first changes are already visible in the market. Established players are challenged by FinTech start-ups and are forced to increase their number of customers and revenues. FinTech start-ups are companies that engage in technology-based financial innovation and thus displace traditional products and services in this area or open up new areas. As a start-up, unlike banks and insurance companies, they do not have any legacy issues, for example in the form of outdated IT structures or historical products. This makes it easier for them to adapt agilely to changing circumstances and customer needs. They work pragmatically as well as strongly customer-centric and often act brazenly in terms of customer acquisition strategies. While many of the FinTech startups are still writing high losses, we are seeing more and more with a company valuation of a billion euros or more. The question is whether these start-ups are merely a passing hype or whether they actually have the chance to establish themselves.

FinTech startups have the potential to challenge established companies for existence

Analogous to FinTech startups today, direct insurance companies entered the market 30 years ago. Back then, too, they were perceived as a real threat to established intermediaries and branches, and quite a few programs were launched to arm themselves. If we look at the actual development of the market today, we see some established direct insurers - but not to the extent feared at the time. Gaining market share is happening at a much slower pace than originally thought.

So what's different about FinTech startups? In short, they are gaining relevance in the market much faster and receiving sufficient follow-on funding from investors to maintain or even expand growth. N26, for example, has already acquired more than 7 million customers since its launch in 2015. Digital insurance broker Clark has also been able to increase its customer acquisition year on year, bringing them to around 300,000 customers by early 2021. The goal is to have more than 1 million users in the next 3 years. The disloyalty of customers to brands has probably never been as pronounced as it is today. In addition, customer behavior is also changing. Tesla, for example, has caused disruption in the automotive industry within a very short time with e-cars. And Amazon has not only displaced traditional book retailing, but defined how online retailing works. These examples suggest that the combination of disloyalty and willingness to change behavior will not stop at the world of established banks and insurance companies. In this context, the recurring crisis of confidence among banks and insurers supports the likelihood of success for the FinTech startups entering the market.

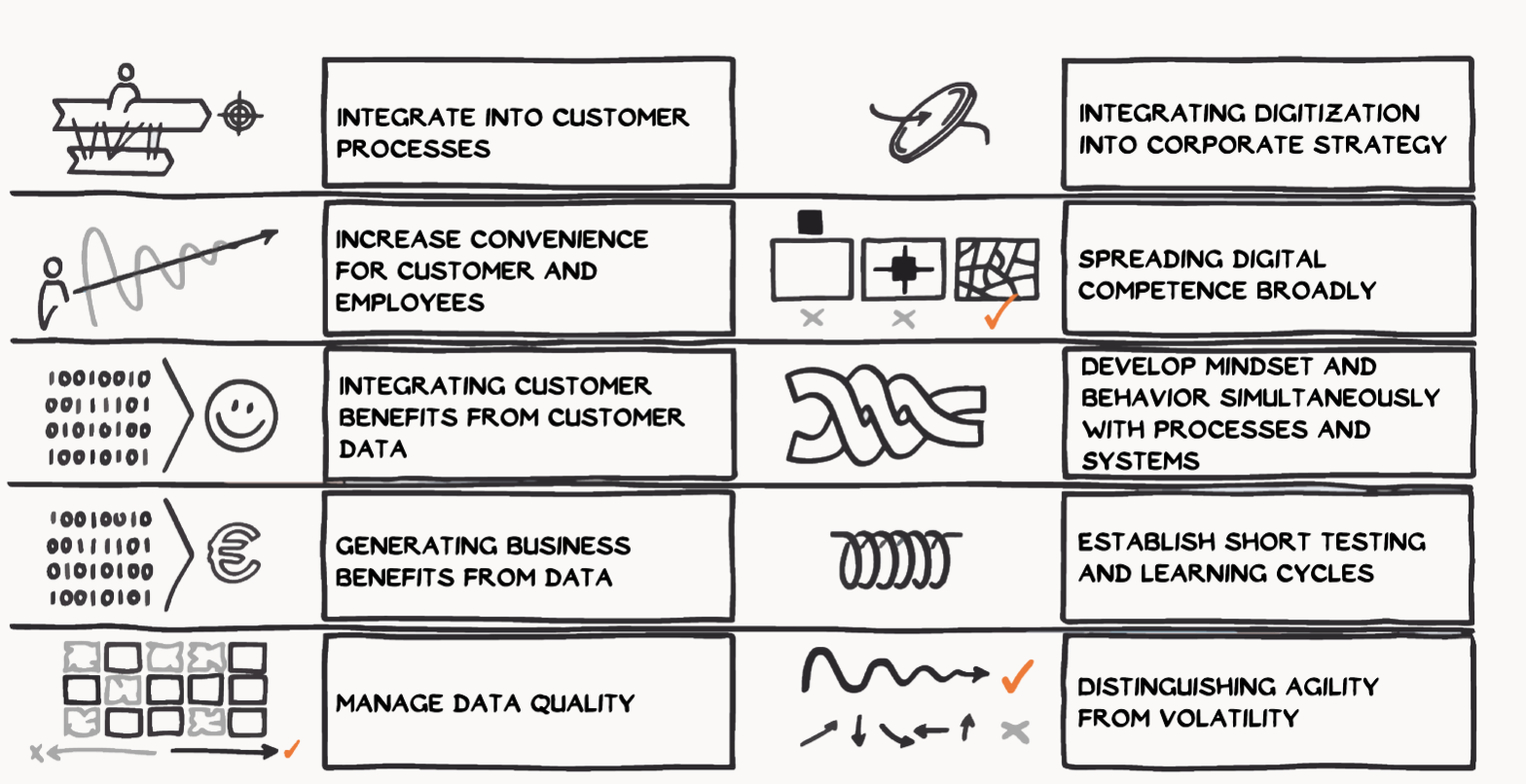

Figure: Principles of digitization

We have identified three factors that have led startups to their success:

1. Decision for a specific customer need and maximum alignment of value-added communication according to this customer need.

FinTech start-ups usually focus on a single customer need at the beginning and serve it simply, cheaply and quickly. In contrast to established banks and insurance companies, which increasingly advertise their products via product features, FinTech start-ups talk to their customers about the benefits or the feeling they can expect from the one product. N26's digital-only banking offering, for example, appeals to customers because they can use the entire banking functionality regardless of location and at virtually any time. At the time, they advertised it as "Banking. But without bullshit" and "Bank branches are soooo 90s." However, a typical current account advertisement usually promotes the following statements: "Open a free current account and secure a bonus of XX €". The Neobroker Trade Republic requires only 1€ for each transaction, fall for comparable transactions with traditional offerers 15€ + 1% of the market value. On the homepage it says in bold letters "Let your money work for you." Not only do startups address true, often unspoken, customer needs, but they usually handle them in the broader dimensions: looks good, feels good, offers options, and solves problems.

This is where we see challenges for insurers and banks if they continue to focus on incrementally improving product features or underlying processes according to financial metrics instead of consistently serving true customer needs in all value dimensions and communicating this.

2. Absolutely pragmatic approach to meeting these customer needs.

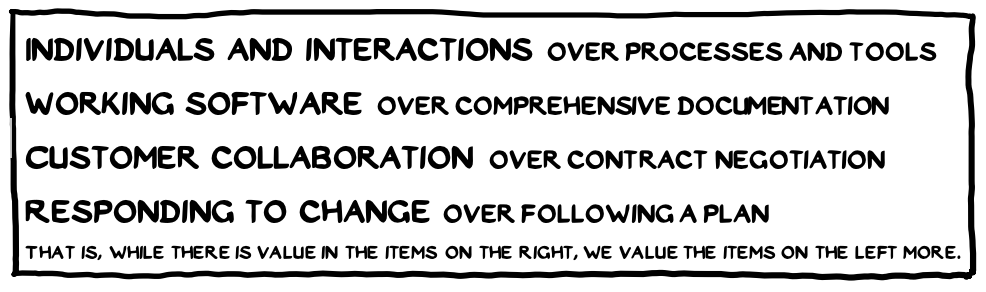

FinTech startups have understood that attractive products for customers do not have to be directly "ready". Typically, products are not yet mature at launch, nor do they always completely meet customer expectations. However, it is enough to retain a large proportion of the customers acquired.1 N26 offers a free checking account, Trade Republic low-cost securities trading, Auxmoney fast loans. When they entered the market, they all met customer needs with as little effort as possible while adding value to a service. In doing so, they are helped by the use of agile methods for organizing work to identify true customer needs, quickly implement customer feedback, and reduce time-to-market. Loosely interpreted according to the Agile Manifesto, they prioritize working solutions above full documentation or, better said, risk avoidance.

In contrast, the established companies sometimes seem to focus on legally watertight solutions rather than on meeting the true needs of their customers. Critically formulated, we see here rather the mantra: risk minimization via solutions that work well for customers.

Figure: Principles from the agile manifesto

3. Scaling at any price

However, in order to be able to challenge the established banks and insurance companies for their market shares and, in particular, to be able to cover the technology costs, FinTech start-ups must grow. The required growth figures are predominantly possible through aggressive, innovative marketing and corresponding marketing budgets. N26 started 2018 with €26.9 million. In that year, the company posted a loss of €73 million. It also incurred a loss of €217 million in the following year. Follow-up investments were nevertheless made. This is not an isolated case. Profitability behind growth potential is also on the agenda of other FinTech startups, especially at the beginning. At the same time, growth requires scalable processes in order to be able to continue to serve the promises made to customers and to keep costs in check - the business is often low-margin and only works through mass. However, scalable here does not mean that all customer problems can be completely automated and served with maximum efficiency. Rather, it is the case that the start-ups find individual solutions for new or rare customer problems only when they occur and prefer to cover the 80 percent in a scalable manner.

Insurers and banks seem to struggle at this point, analogous to Clayton Christensen's Investor's Dilemma. Compared to the existing products, the expected revenues in the near future from the new, expensive-to-acquire customers are too low and too uncertain. The budgets required can be invested in improving existing structures with a supposedly higher probability of success. It is not uncommon to see a focus on "securing aging inventory and expanding existing business".

FinTechs also have weak points and only a few manage to establish themselves

As in every industry, there are also enough FinTech start-ups that fail. Responsible for this is, for example, the mere copying of competitors' business models, although there are already enough providers with better offers, or also the underestimated customer acquisition costs with a lack of willingness to invest by investors. Finance is a matter of trust and therefore an unknown FinTech will only succeed in positioning itself sustainably on the market if it offers convincing added value. In the long term, therefore, some FinTech start-ups will enter into cooperative ventures with the established players in the industry, but are unlikely to replace them. The established players are also launching an offensive with their own mobile payment system, and some insurers are now offering the services and business models of the InsurTechs themselves by cooperating with the start-ups or buying them. But can the incumbents with their legacy businesses seriously operate in a more sustainable, cost-effective and customer-focused way than the FinTechs in their specialty?

Away from the price and feature war in the start-ups' specialty area and toward consciously playing to and using one's own strengths

Unfortunately, the established insurers and banks are currently still thinking strongly in terms of products and their sales, rather than customer problems and solutions - and this is one of the reasons why they are struggling with revenue losses. While processes are already being optimized and a better customer journey is being offered by banks and insurance companies positioning themselves in a more customer-oriented way, it is questionable whether this will be enough. Instead of trying to copy or outdo FinTech start-ups, the following question should be asked: How can the true, often unspoken customer needs be identified and satisfied? After all, customers do not want a renewed product variant of a pension savings plan; they want to make flexible provisions for retirement in order to achieve freedom and security. They don't want to take out construction financing, but prefer to invest the rent in their property. They want to know that their money is in a safe place and that they will feel carefree if the worst comes to the worst thanks to the right coverage, and they don't want to be sold additional insurance policies.

Existing business models will have a hard time competing sustainably with startups in their specialty areas in the areas of customer orientation and price due to their legacy. Corporations have been investing for years in operational excellence, cost optimization programs, customer journeys, persona concepts and the implementation of agile methods - to name just a few. Of course, there should be no stopping there, but the established ones are more likely to get back into a Blue Ocean scenario where they can play to their strengths. For example, many of the larger banks and insurance companies have a broad range of high-quality consulting expertise, which can take away a lot of worry and effort, especially from younger customers, by designing, explaining and implementing customized solutions for them. After all, very few people want to read up on the Internet themselves and then make the right decision in terms of sustainability or personal risk profile.

If you have any questions or would like to discuss the topic of FinTechs in more detail, please contact the author (Axel Frick, Manager at Axel.Frick@ums-gmbh.com) and the co-author (Tobias Thull, Tobias.Thull@ums-gmbh.com).

We look forward to it!

[1] https://bankingblog.accenture.com/deutsch/agile-it-finanzwirtschaft?lang=de_DE

[2] https://www.it-finanzmagazin.de/banken-kunden-altlasten-samstagsarbeit-83813/

[3] https://next.ergo.com/de/KI-Robotics/2021/AI-Factory-Kuenstliche-Intelligenz-AWS-Cloud.html

[4] https://www.it-finanzmagazin.de/banken-kunden-altlasten-samstagsarbeit-83813/

More

Inspirations

- Agility without stability is a waste of energy

- Digitization principles or digitization strategy?

- Fit for VUCA?

- Agility in financial services